Courtesy pic

KUALA LUMPUR: A doctor claimed to have fallen victim to online banking fraud after she lost RM13,000 from her account through three CIMB Clicks transactions yesterday.

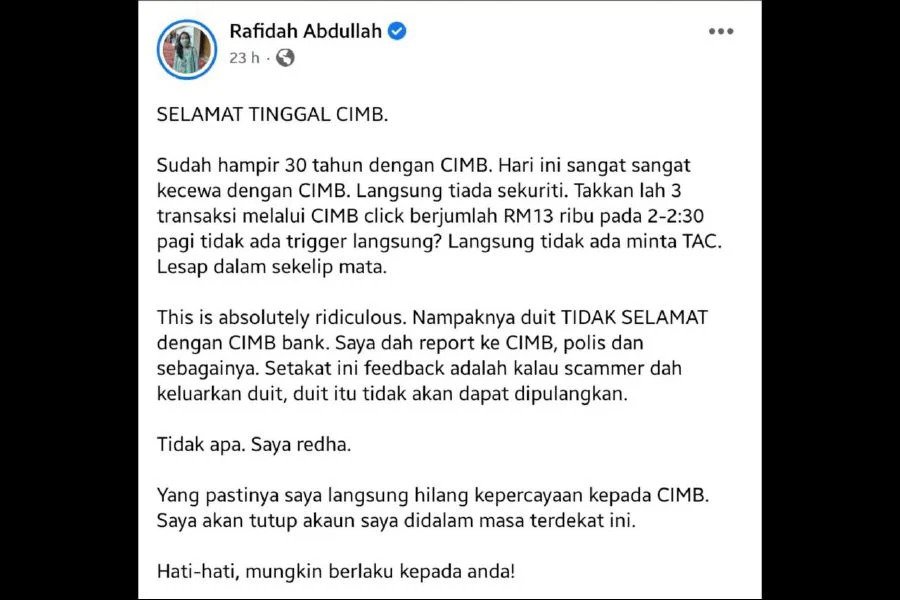

Nephrologist Dr Rafidah Abdullah shared on social media that the transactions occurred at around 2am on Friday but she did not receive any TAC number.

“I have been with CIMB for almost 30 years. Very disappointed with CIMB today. Absolutely no security. Three transactions went through CIMB Clicks totalling RM13,000 at around 2am in the morning and there is no trigger at all? I did not receive any messages asking for TAC. The money is gone in an instant.

“This is absolutely ridiculous. It seems that our money is not safe with CIMB bank. I have reported the matter to CIMB, the police and so on. So far the feedback is that if the scammer has taken out the money, the money will not be returned.

“It’s okay. I accept it. For sure, I immediately lost faith in CIMB. I will close my account in the near future. Be careful, it might happen to you!” she wrote on Facebook.

Dr Rafidah’s posting has since gone viral with close to 10,000 shares and over 20,000 likes.

CIMB has been trending on Twitter since. Many people have come forth to share similar experiences of money going missing from their bank accounts.

In a subsequent posting on Facebook, Dr Rafidah shared that she is an iPhone user and added that a report has been lodged with Bank Negara Malaysia (BNM).

“Just so everyone knows, I use an iPhone and don’t upload weird apps. Maybe someone can get my information. I have removed all applications from the phone and reset it.

“I have accepted that the money is not my rezeki. But what worries me is what I have been reading (since my first post). It seems that many people are affected by this scam/hack.

“I am saddened to hear about the aunties and uncles and the people who lost their income and savings. What do these banks do?

“Hello, that’s their (the public’s) right. Get their money back. CIMB, why are you doing this?

“I hope Bank Negara Malaysia takes strict action against CIMB and any bank that gives way for robbers to rob Malaysians of their rights. It seems that now you have to put the money under the pillow!,” her post read.

In another update, Dr Rafidah said CIMB has reached out to her over the incident.

“Thank you CIMB for calling me. According to them, I must have clicked on some link several days ago, which enabled another iPhone 6 to register an account for me.

“My question is simple: I have had a CIMB account for almost 30 years. Did I ever register two phones for this account? Definitely not. The phone number never changed. So, the three transactions to the ‘registered’ iPhone 6 does not require TAC.

“Even if you want to register a new phone, you don’t need TAC. Why is that? I demand CIMB to tighten security, only give one number for CIMB Clicks and if there is a register/change to new or other phone, please call the account owner.

“I don’t think this is rocket science. I expect it to be done immediately. Use a little brain. Tighten the SOP. This is the individual right of the Malaysian community. Their hard-earned money, for goodness sake.”

Source : New Straits Times